IBKR is best for college student people who would like to retract its sleeves and you will discover, for the use of of equipment you to definitely assistance advanced trading. Fidelity is the best for college student buyers searching for an all-up to excellent brokerage having greatest-in-group reduced-prices directory fund you to service a lot of time-name funding. FirstTrade is all of our better see for the directory of funding things, low-cost change, instructional information and student-amicable trade system. Morgan Chase also provides a variety of lending products, and bank accounts, handmade cards, and personal financing. So it total suite of characteristics helps it be a single-stop go shopping for of a lot economic means. J.P. Morgan’s trading program is utilized in the fresh Pursue cellular application, taking a good experience to have Pursue users.

Lower composed margin rates2

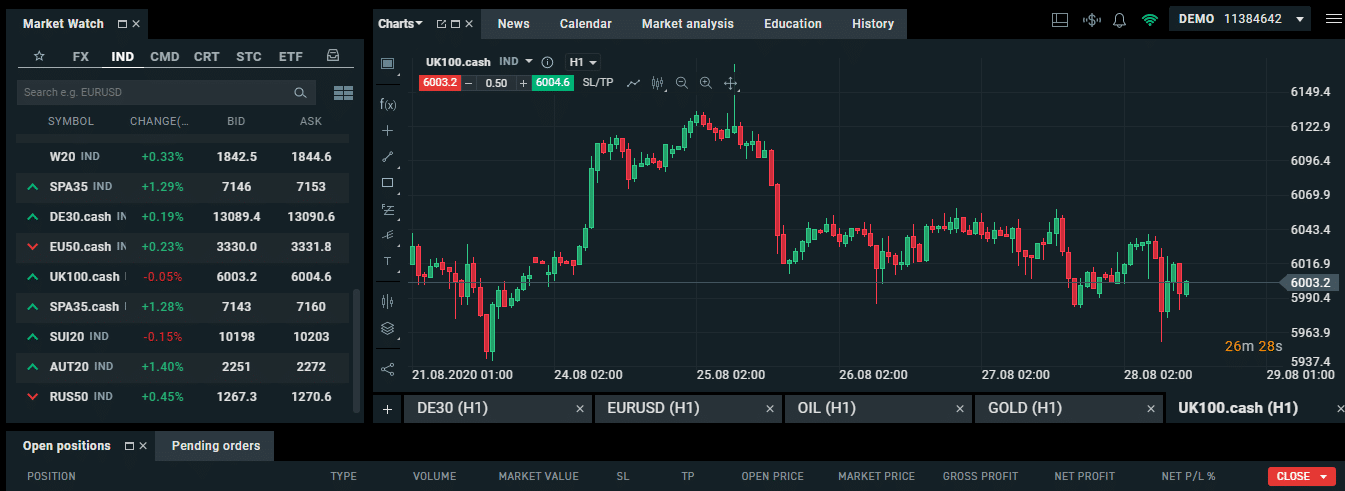

When you’ve transported money into your brokerage membership, you may also imagine committing to items beyond a core bucks otherwise sweep membership. When you are such accounts pay focus, you are lost the greater prospective gains of other assets you to definitely hold a heightened threat of loss. Because the user interface is not as clean or modern as the compared to almost every other brokers, it becomes the work done. Interactive Agents is also a fantastic choice to have options people, buyers, and the ones trading to the margin.

Register on your own investments

- This type of alternatives, plus the accessibility and independency, create Fidelity a great option for beginners looking to build the investment.

- The best on the internet brokerages usually don’t fees a month-to-month account government commission.

- They implies that you stick to tune in order to meet forget the needs while keeping the chance from the peak your’re also comfortable with.

- Based on your feel level, you can even choose individual carries, common money, ETFs or a managed profile.

- Robinhood scores only 3/5 for convenience because of minimal customer support possibilities along with shell out-walled lookup at the rear of Robinhood Gold.

Advisory fees is waived for the earliest 3 months, allowing the newest people to understand more about the platform risk free. Then, the brand new yearly gross https://ideban.com/1404/06/24/trading-to-the-margin-the-benefits-and-you-can-cons-inside-2025/ consultative commission is 0.20% to own a just about all-directory money portfolio otherwise 0.25% to own a mixed profile of Leading edge ETFs and you will positively managed common money. We have found a comparison of the very well-known educational has supplied by college student change systems.

An investments membership is going to be people money account containing ties, cash or other holdings. Most often, change membership means day buyer’s primary account. These traders usually buy and sell assets appear to, usually inside the exact same change training, in addition to their profile are susceptible to unique controls because of this. The newest possessions held inside a trading and investing account is split up from someone else which can be element of a lengthy-label purchase and you will hold approach. Your claimed’t manage to exchange or purchase crypto, futures or fractional shares, and this we feel distance themself from Merrill Boundary’s benefits. At the same time, the new trading platform isn’t the most scholar-friendly of your own platforms within scores.

Motley Fool Money is a good Motley Fool service you to definitely prices and you will ratings important things to suit your everyday currency issues. I as well as such eToro’s good crypto-trading has and the thorough informative materials on eToro Academy. At the same time, you obtained’t initiate getting desire in your lazy dollars unless you has an equilibrium of at least $twenty five,100.

But how do funded trading accounts work, and exactly why are they to be very popular? Within this publication, we’ll falter exactly how this type of membership perform, which it’re also to own, and just why they’re just the right chance for the change profession. If you’d like the idea of hands-out of paying, common money was your best buddy.

See the Fidelity virtue yourself

Obviously, profits on the brings and you can ETF are at the industry-amount of $0, however, possibilities rates $1 to have a circular-travel offer – very no progressive commission in conclusion the right position – and’re also capped in the $10 for each toes for each order. A top change platform also can provide online streaming reports and will actually provide a much better trade performance, assisting you to support the really glamorous rate you are able to. Right now, really online agents require no lowest deposit to open up a merchant account, commission-totally free stock and you will ETF investments, and also the way to obtain fractional shares. Thus, the newest buyers will start trading that have a little investment including $one hundred. J.P. Morgan Mind-Brought Spending also provides people the ability to invest directly in stocks, ETFs, common finance and options.

And Charles Schwab ETFs, you have access to more dos,100000 3rd-party, commission-100 percent free ETFs layer a general listing of asset classes—and its own ETF screeners would be best-in-classification. Stash lets you choose tips invest—if your’lso are a home-brought Doing it yourself trader otherwise choose automated investing you to definitely eliminates the fresh guesswork. You’ll have access to a personal broker membership, a pension membership, and you will Wise Portfolio—a robo-mentor you to definitely produces an excellent diversified collection considering your own exposure reputation.

Talk about disregard the options

Your otherwise a member of family has a disability and require availability to the most tax- productive and flexible way to save and you will dedicate. Rather than a timeless otherwise Roth IRA, a Sep IRA lets your organization lead to one fourth of the settlement or $70,100000, any type of try quicker, in the 2025. However, you’lso are expected to contribute a similar part of paycheck for everyone qualified staff. You’re also gonna purchase a property in the next about three so you can seven many years and want high output than just a checking account brings — and you will don’t head stomaching volatility in the act.

With a good margin membership, you can purchase to the bucks you may have or borrow cash to shop for ties (which the definition of “to purchase to the margin”). Merely buyers which know the dangers, including the probability of magnified loss, should consider opening an excellent margin account, which is ruled by many laws and regulations. Extra also offers subject to terms and conditions, go to robinhood.com/hoodweek for more information.