The Ultimate Guide to Forex Currency Trading Brokers

In the ever-evolving world of financial markets, the Forex (foreign exchange) market stands out due to its incredible growth and accessibility. For both novice and experienced traders, understanding the role of Forex currency trading brokers is crucial in navigating this vibrant marketplace. Whether you are looking to trade major currency pairs, exotic currencies, or derivatives, the choice of broker can significantly impact your trading experience. One of the top platforms to check out is forex currency trading broker protradinguae.com, which offers a user-friendly interface and valuable resources.

What is a Forex Broker?

A Forex broker acts as an intermediary between retail traders and the interbank forex market. The primary function of these brokers is to provide access to trading platforms where clients can buy and sell currency pairs. They enable traders to speculate on the price movements of currencies and provide the necessary tools and resources for executing trades efficiently.

Types of Forex Brokers

Forex brokers can be categorized into three primary types, each offering different advantages and disadvantages:

1. Market Makers

Market makers provide liquidity by offering buy and sell prices, essentially setting the market for their clients. They profit from the spread – the difference between the bid and ask prices. While they can offer a more controlled trading environment, some traders may be wary of potential conflicts of interest.

2. ECN Brokers

Electronic Communication Network (ECN) brokers connect traders directly to the interbank market. This allows for tighter spreads and access to more competitive pricing. However, ECN brokers typically charge a commission on trades, making them more suitable for serious traders looking for minimal spreads.

3. STP Brokers

Straight Through Processing (STP) brokers automatically route orders to liquidity providers without intervention. This type of broker can offer competitive spreads and faster execution times. However, they might charge higher fees compared to market makers.

How to Choose a Forex Broker

Choosing the right Forex broker is paramount to your trading success. Here are several factors you should consider:

1. Regulation and Security

Ensure that the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA. Regulation helps safeguard your funds and ensures fair trading practices.

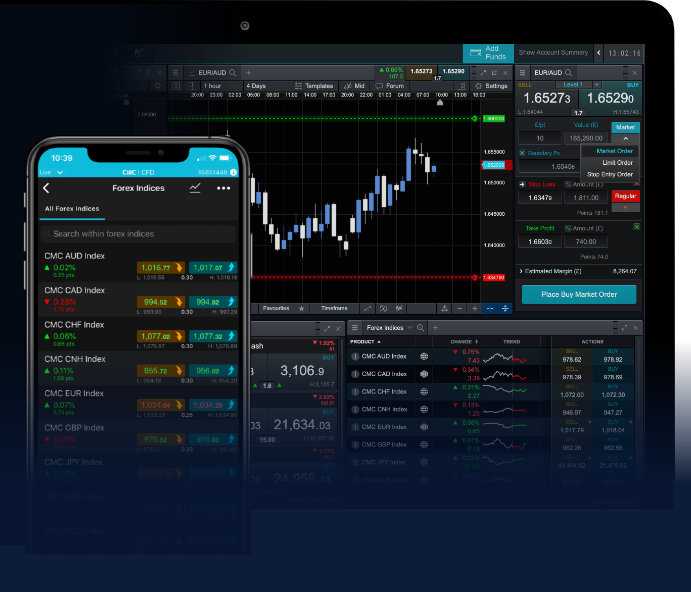

2. Trading Platforms

Look for brokers that offer robust trading platforms. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular choices among traders due to their user-friendly interfaces and numerous features, such as automated trading capabilities.

3. Fees and Spreads

Compare the fees and spreads offered by different brokers. While some brokers offer zero commission trades, they might compensate with wider spreads. Always check the total cost of trading to get a clearer picture.

4. Customer Service

Reliable customer support is crucial, especially for new traders who might need assistance. Ensure that your chosen broker provides 24/5 support through various channels, such as live chat, email, and phone.

Common Trading Strategies

Once you’ve selected a broker, developing a trading strategy is essential for success. Here are some common trading strategies employed by Forex traders:

1. Scalping

Scalping involves making numerous trades throughout the day to capitalize on small price movements. This strategy requires quick decision-making and can be highly intense but rewarding for traders with the right mindset.

2. Day Trading

Day trading entails opening and closing positions within the same trading day. Traders often utilize technical analysis and short-term trends to make informed decisions.

3. Swing Trading

In contrast to day trading, swing trading involves holding positions for several days or even weeks. This strategy focuses on capturing larger price movements and is suitable for those who cannot monitor the market constantly.

Risk Management in Forex Trading

Effective risk management is critical in Forex trading. Here are several techniques to help protect your capital:

1. Use Stop Loss Orders

Setting stop-loss orders can help limit potential losses on trades. This automatic sell order will close your position if the market moves against you.

2. Diversify Your Portfolio

Avoid putting all your capital into one currency pair. Diversifying your trades across different pairs can reduce risk and increase potential returns.

3. Practice Proper Position Sizing

Calculate your position size based on your trading capital and risk tolerance. A general rule of thumb is to risk no more than 1-2% of your capital on a single trade.

Conclusion

Forex trading can be a rewarding venture when approached with careful planning and research. Selecting the right broker is the first step towards successful trading. By understanding the various types of brokers, assessing fees, and implementing proper risk management strategies, you can enhance your overall trading experience. Remember, continuous learning and adaptation are key components to thriving in the Forex market.